Small Business Vs Corporation

About the author s. Small business owners often choose to structure as an llc because it offers more freedom than corporation structures.

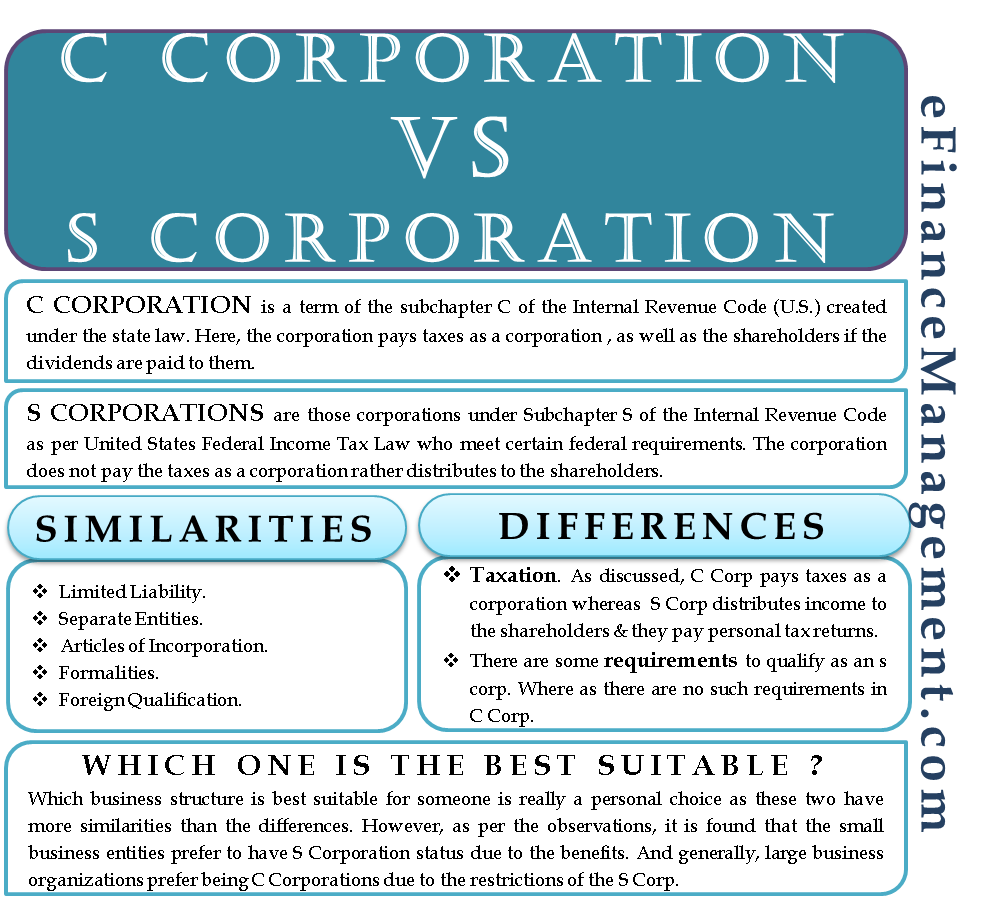

C Corporation Vs S Corporation The Similarities The Differences

C Corporation Vs S Corporation The Similarities The Differences

For example a business owner that operates a c corporation is essentially taxed twice.

Small business vs corporation. Small business administration sba also highly recommends the entity to immigrant entrepreneurs. One common misconception online is that s corp is a business structureits not. How small businesses can have a leg up against corporations.

While an s corporation has strict rules against nonresident alien shareholders c corporations might just be the perfect entity choice for immigrant owned businesses. With more employees and more resources it may feel like youre the underdog in the fight but this doesnt have to be the case. You may have the opportunity to take longer lunches work from home or spend a little more time on balancing your personal life.

Competing with large corporations can be an intimidating situation for anyone especially if youre a small business. In 1958 congress created the s corporation also called the small business corporation so that smaller businesses could get similar tax advantages as a corporation but without the double taxation. The fundamental difference between s corps and c corps is that an s corporation is a pass through tax structure and a c corporation is a legal business entity taxed as a corporation.

Because the environment in a small business is ever changing your schedule may be also. Again its a tax status sometimes called a tax designation. The protection of personal assets is a benefit that attracts many business owners to the s corporation but this structure also provides other perks especially compared to other types of corporations.

But before making this critical decision its important to know the. The structure of small business is often times a little more flexible than those of large corporations. An s corporation doesnt have that issue.

First the corporation is taxed on its profits for the year and then shareholders including the owner are taxed on the dividends they receive from the corporation.

S Corp Vs Llc Everything You Need To Know The Blueprint

S Corp Vs Llc Everything You Need To Know The Blueprint

How To Compete With Corporate When Hiring For Your Small Businessmarketcircle Blog

How To Compete With Corporate When Hiring For Your Small Businessmarketcircle Blog

Small Business Incorporation In Canada Is It For You Freshbooks Blog

Small Business Incorporation In Canada Is It For You Freshbooks Blog

Small Business Vs Large Corporations Redalkemi

Small Business Vs Large Corporations Redalkemi

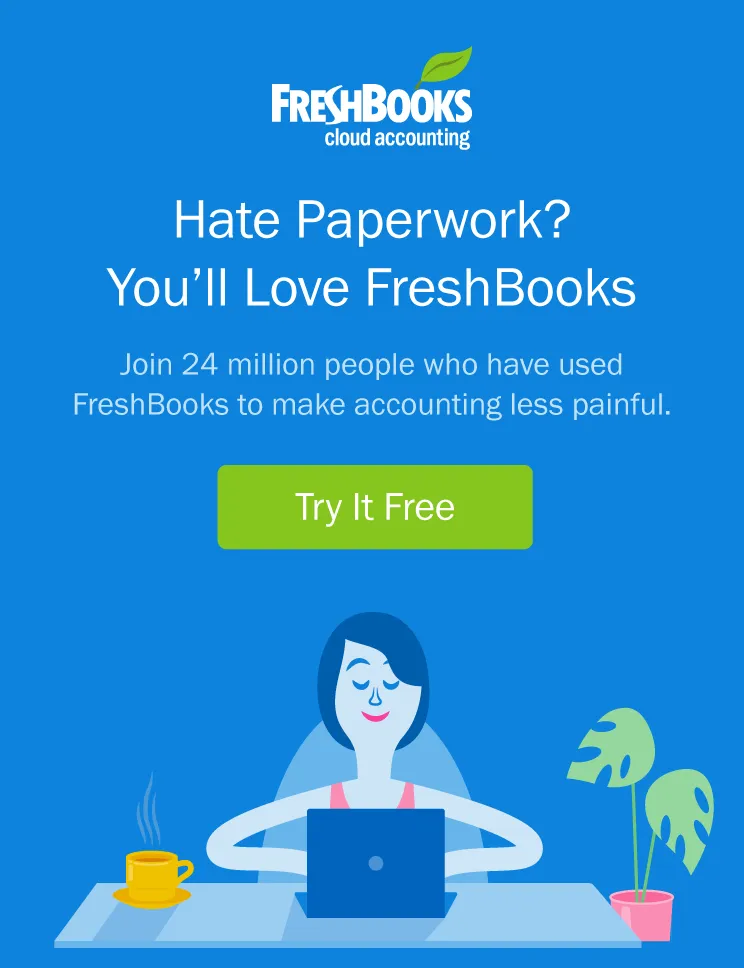

5 Questions Smb Owners Must Answer When Forming An Entity Infographic Bizfilings

5 Questions Smb Owners Must Answer When Forming An Entity Infographic Bizfilings

New Tax Law Should Benefit Many Small Business Owners Jax Daily Record Jacksonville Daily Record Jacksonville Florida

New Tax Law Should Benefit Many Small Business Owners Jax Daily Record Jacksonville Daily Record Jacksonville Florida

The Government Doesn T Care About Small Business Survey Says Inc Com

The Government Doesn T Care About Small Business Survey Says Inc Com

Small Business Marketer Vs Corporate Marketer Package Comparison Activedemand

Small Business Marketer Vs Corporate Marketer Package Comparison Activedemand

Large Corporations Helping Small Businesses Sam S Club Leads The Way

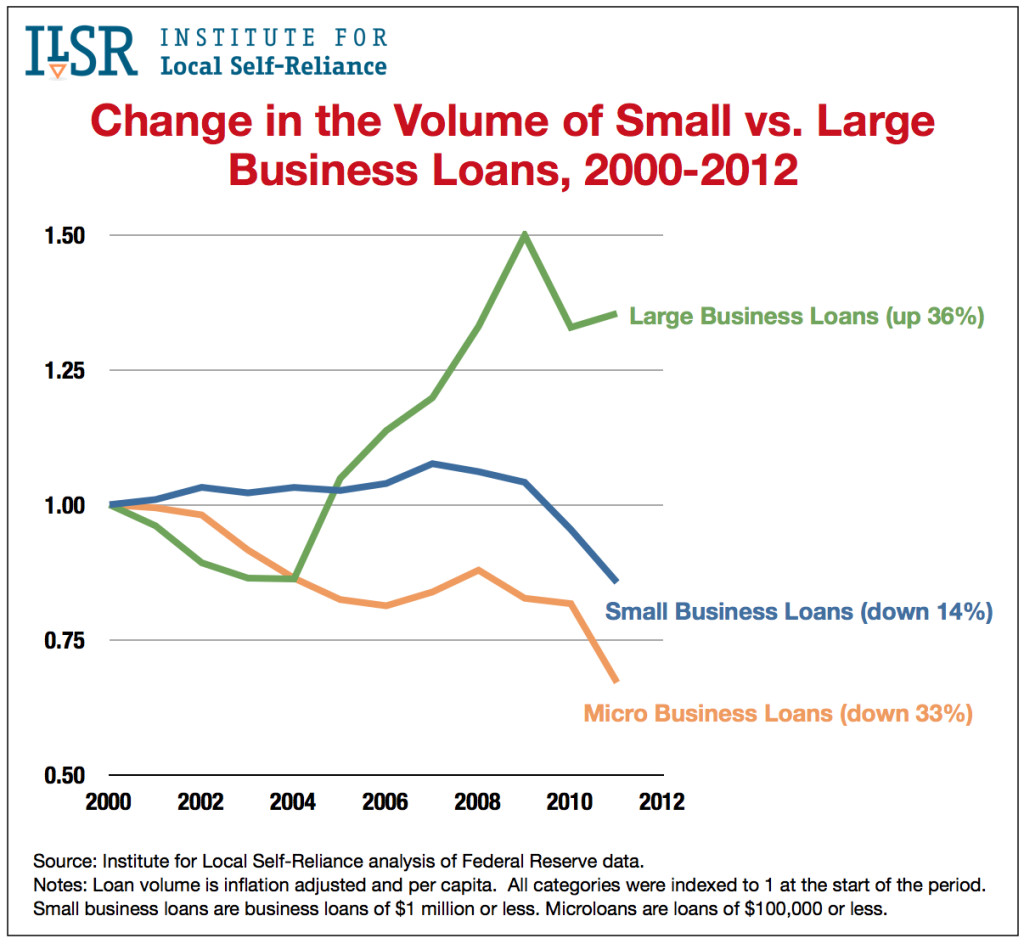

Access To Capital For Local Businesses Institute For Local Self Reliance

Access To Capital For Local Businesses Institute For Local Self Reliance

Kalfa Law Business Tax Rates In Canada Explained 2020

Kalfa Law Business Tax Rates In Canada Explained 2020

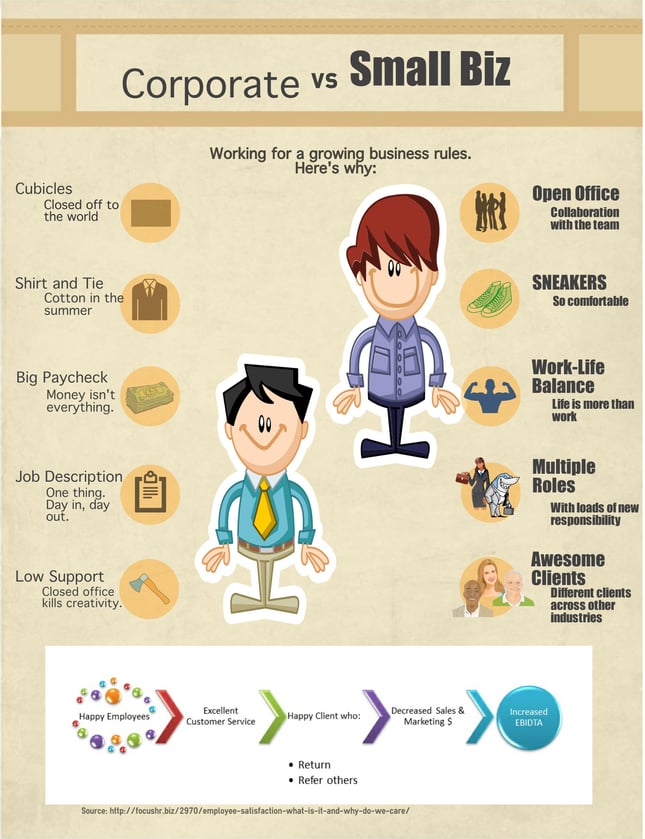

Infographic Working For A Small Business Vs Corporate America

Infographic Working For A Small Business Vs Corporate America

Small Businesses And Auto Enrolment Vintage Corporate Limited

Small Businesses And Auto Enrolment Vintage Corporate Limited

Big Corporation In Small Business Isometric Banner Stock Vector Illustration Of Achievement Business 157643434

Big Corporation In Small Business Isometric Banner Stock Vector Illustration Of Achievement Business 157643434

Home Business Vs Corporation Buildings Of Small Company And Royalty Free Cliparts Vectors And Stock Illustration Image 60298051

Home Business Vs Corporation Buildings Of Small Company And Royalty Free Cliparts Vectors And Stock Illustration Image 60298051

Small Business Big Business Management Corporation Png 500x500px Small Business Big Business Brand Business Business Operations

Small Business Big Business Management Corporation Png 500x500px Small Business Big Business Brand Business Business Operations

Llc Vs S Corp Vs C Corp What Is The Best For Small Business

Adfiap Welcomes Back Small Business Corporation Adfiap

Adfiap Welcomes Back Small Business Corporation Adfiap

Home Business Vs Corporation Buildings Small Stock Vector Royalty Free 455336752

Home Business Vs Corporation Buildings Small Stock Vector Royalty Free 455336752

Cutting B C S Small Business Tax Rate Will Discourage Businesses From Growing Fraser Institute

Cutting B C S Small Business Tax Rate Will Discourage Businesses From Growing Fraser Institute

Big Corporation Vs Small Business What S Best For You Glassdoor

Big Corporation Vs Small Business What S Best For You Glassdoor

Mobile Rdc A Growth Opportunity Among Small Business And Corporate Customers Aite Group

Mobile Rdc A Growth Opportunity Among Small Business And Corporate Customers Aite Group

Taxes Large Corporations Vs Small Businesses And Startups

Taxes Large Corporations Vs Small Businesses And Startups

Covid 19 Small Business Loan Partnership And Expansion Of Emergency Response Fund Barberton Community Foundation

Covid 19 Small Business Loan Partnership And Expansion Of Emergency Response Fund Barberton Community Foundation

Cannabis Big Business Vs Little Business Lampreda

Cannabis Big Business Vs Little Business Lampreda

Llc Or Corporation Legal Business Book Nolo

Llc Or Corporation Legal Business Book Nolo

Www Euquant Com Why Small Business Hiring Is On Hold

How Do I Choose A Legal Structure For My Small Business

How Do I Choose A Legal Structure For My Small Business

How To Start And Run Your Own Corporation S Corporations For Small Business Owners Hupalo Peter I 9780967162447 Amazon Com Books

How To Start And Run Your Own Corporation S Corporations For Small Business Owners Hupalo Peter I 9780967162447 Amazon Com Books

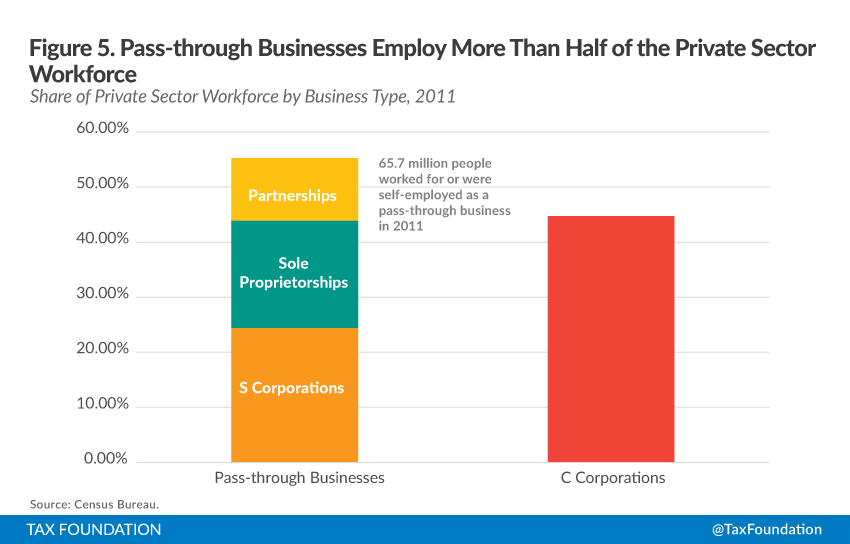

An Overview Of Pass Through Businesses In The United States Tax Foundation

An Overview Of Pass Through Businesses In The United States Tax Foundation

Llcs Vs Corporations Infographic

Llcs Vs Corporations Infographic

.jpg)