Fdic Finance Charge Chart

FFIEC 031 through 034. 08102012 The FDIC has recently completed a compliance exam and mentioned the obvious error rule in relation to the APR calculation on open-end credit.

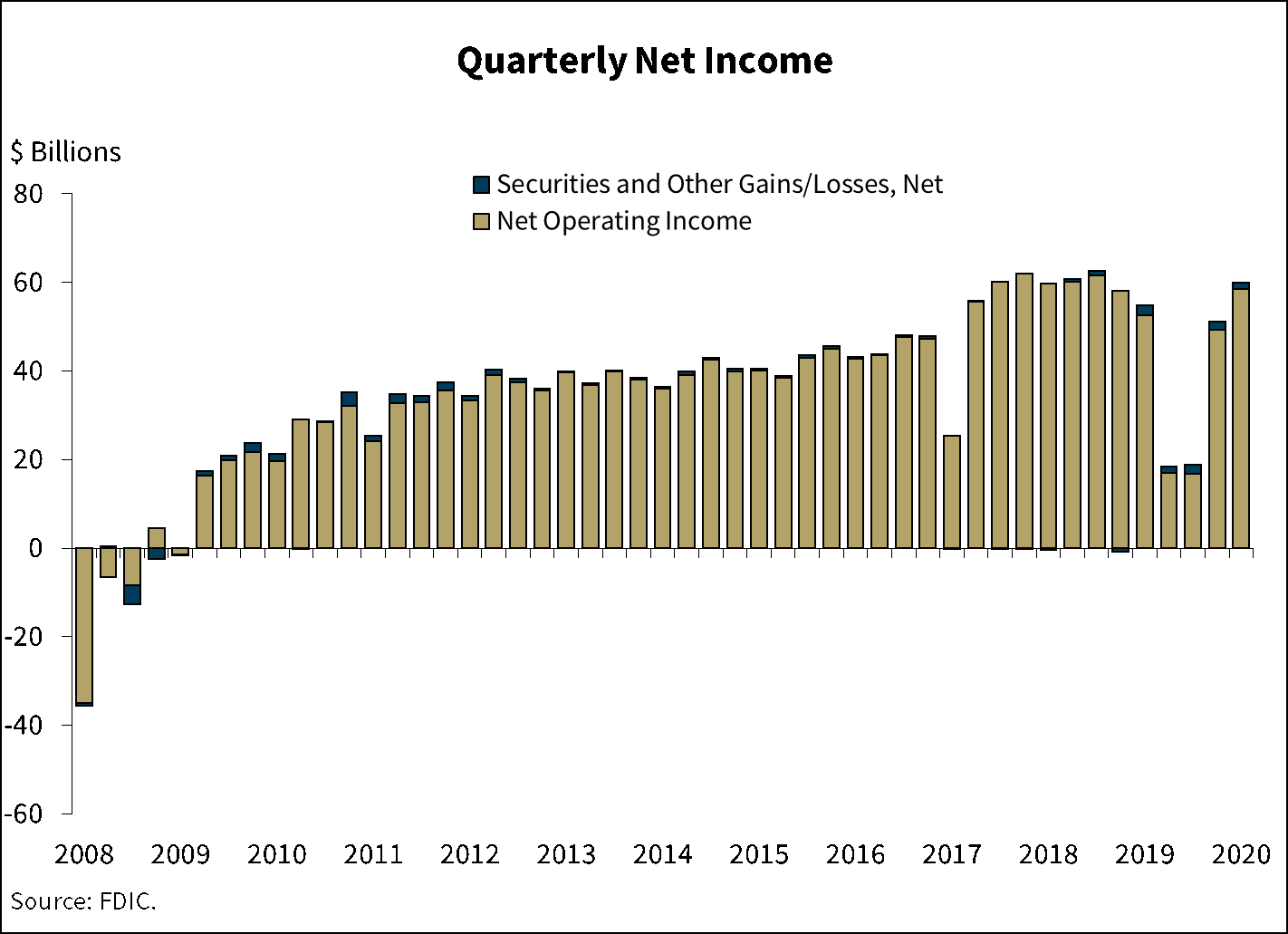

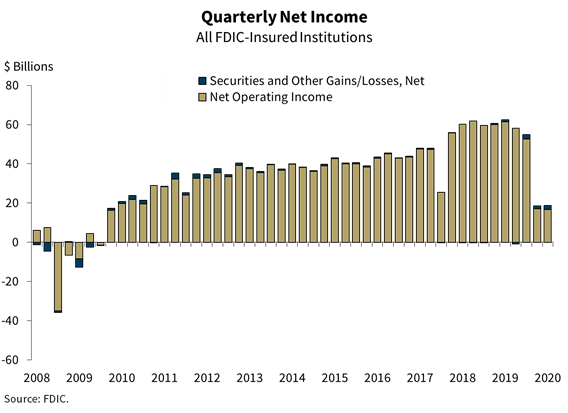

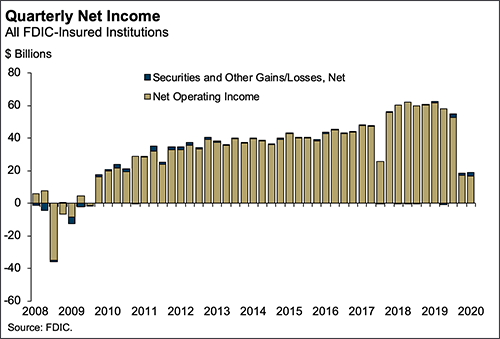

Fdic Bank Deposits Up 1 Trillion In Q2 Net Income Down 70 Year Over Year Average Roa At 0 36 Regulatory Report

Fdic Bank Deposits Up 1 Trillion In Q2 Net Income Down 70 Year Over Year Average Roa At 0 36 Regulatory Report

Finance Charge and the APR Finance Charge Open-End and Closed-End Credit.

Fdic finance charge chart. Along with APR disclosures the disclosure of the finance charge is central to the uniform credit cost disclosure envisioned by the TILA. Creditors may comply with paragraphs a6 of this section or with paragraph b6 of this section at their option. Credit Card Comparison Chart.

This program includes relevant finance charge and APR tolerances for verifying the accuracy of annual percentage rates and finance charges on loans secured by real estate or a dwelling. If you would like print this study aid for future reference. Note that where a particular fee or charge such as the flood certification fee can be either a finance charge or not a finance charge note that such feecharge is listed twice with a different charge code assigned.

The 5 charge is not a finance charge. FDIC Money Smart Charge It Right Study Aid for Young Adults. Credit Card 1 Credit Card 2 Credit Card 3 Name of credit cardcompany What is the APR Annual Percentage Rate.

If the amount financed is 5000 and the finance charge is 91250 the actual APR will be 1825. Fee for cash advance on debit card. By the way I am FDIC regulated not OCC.

Finance Charge Open-end Credit 2266a 15 Determining the Balance and Computing the Finance Charge 15 Finance Charge Resulting from Two or More Periodic Rates 17 Annual Percentage Rate Open-End Credit 18 Accuracy Tolerance 22614 18 Determination of APR 18 Subpart C Closed-End Credit 22 Finance Charge Closed-End Credit 22617a 22 Annual. 2264 The finance charge is a measure of the cost of consumer credit represented in dollars and cents. The 5 charge is not a finance charge.

04052018 FDIC guidance on extended overdraft fees 10092015 This March 2014 newsletter issued by the Kansas City Branch of the FDIC includes an article about the FDICs view of and concerns about the practice of charging fees when a consumers deposit account has remained overdrawn for more than a prescribed number of days. Regulation Z also was amended to implement section 1204 of the Competitive Equality Banking Act of 1987 and in 1988 to include adjustable-rate mortgage loan disclosure requirements. Creditor can charge including interest fees and charges im-posed for credit insurance debt cancellation and suspension and other credit-related ancillary products sold in connection with the transaction.

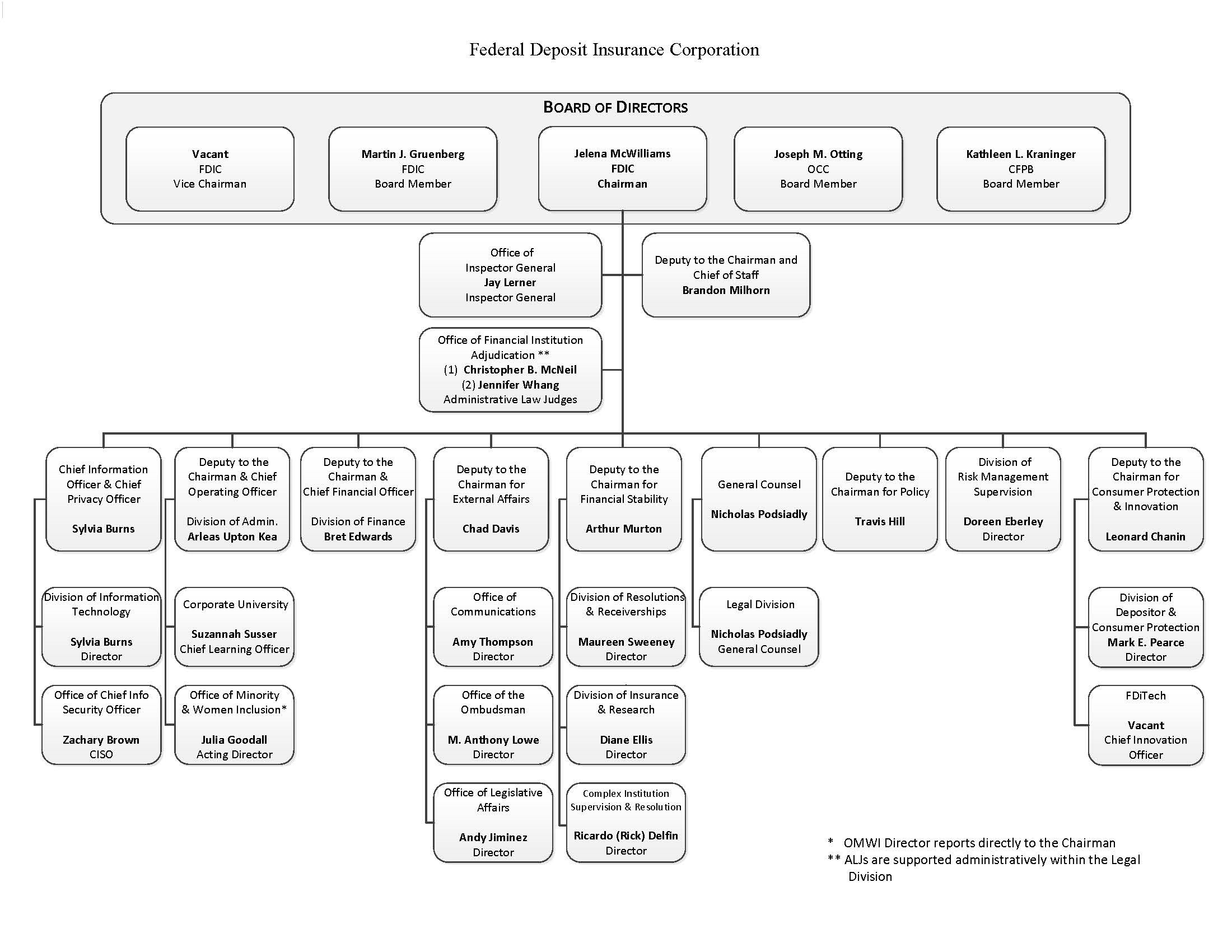

Learn about the FDICs mission leadership history career opportunities and more. 21052021 Federal Financial Institutions Examination Council FFIEC Consolidated Reports of Condition and Income 1985-2000. Notes Charge-offs which are the value of loans removed from the books and charged against loss reserves are measured net of recoveries as a percentage of average loans and annualized.

The total charges must be expressed as a total dollar amount and as an annualized rate referred to as the. Reform Act of 1980 the Fair Credit and Charge Card Disclosure Act of 1988 and the Home Equity Loan Consumer Protection Act of 1988. The Federal Deposit Insurance Corporation FDIC is an independent agency created by the Congress to maintain stability and public confidence in the nations financial system.

Are banks permitted to charge a fee to customers or non customers to withdraw funds using their Visa debit card inside the bank not by ATM. The key is bona fide and reasonable. 09062020 The online Annual Percentage Rate program is a tool for verifying annual percentage rates and reimbursement adjustments.

Use this chart to compare credit card offers you might receive. A 5 service charge is imposed for each item that results in an overdraft on an account with an overdraft line of credit while a 25 service charge is imposed for paying or returning each item on a similar account without a credit feature. The finance charge generated by an APR of 18 applying the one-quarter of one percent APR tolerance to 1825 for that loan would be 900.

It also contains rules on evaluation of a consumer s ability to make the required payments under the terms of an account limits the. A 5 service charge is imposed for each item that results in an overdraft on an account with an overdraft line of credit while a 25 service charge is imposed for paying or returning each item on a similar account without a credit feature. This subpart contains rules regarding credit and charge card application and solicitation disclosures.

This matrix is a list of various fees and charges considered to finance charges and the applicable citation to Section 2264 of Regulation Z or the Official Commentary to Reg Z. Use this chart to compare credit card offers you might receive. 6 Amount of finance charge and other charges.

FDIC Money Smart Charge It Right Study Aid for Adults. If they are bona fide and reasonable they are exempt from the finance charge for real estate secured loans. If you charge a 500 document preparation fee then you better be able to document that it costs you 500 to prepare the documents.

The components of the finance charge shall be individually itemized and. Credit Card 1 Credit Card 2 Credit Card 3 Name of credit cardcompany What is the APR Annual Percentage Rate. The difference between 91250 and 900 produces a numerical finance charge tolerance of 1250.

Credit Card Comparison Chart. Rate Any Charges Not Paid In A Timely Manner Shall Be Subject To Finance Charges Set Forth In as 5 stars Rate Any Charges Not Paid In A Timely Manner Shall Be Subject To Finance Charges Set Forth In as 4 stars Rate Any Charges Not Paid In A Timely Manner Shall Be Subject To Finance Charges Set Forth In as 3 stars Rate Any Charges Not Paid In A Timely Manner Shall Be Subject To Finance Charges Set Forth In as 2 stars Rate Any Charges Not Paid In A Timely Manner Shall Be Subject To Finance. The amount of any finance charge debited or added to the account during the billing cycle using the term finance charge.

Banks Vs Credit Unions Guide Want To Know What Types Of Forms And Disclosures Oak Tree Business S Credit Unions Vs Banks Credit Union Credit Union Marketing

Banks Vs Credit Unions Guide Want To Know What Types Of Forms And Disclosures Oak Tree Business S Credit Unions Vs Banks Credit Union Credit Union Marketing

How To Spend In 1 Simple Diagram Spending Money Budgeting Saving For College

How To Spend In 1 Simple Diagram Spending Money Budgeting Saving For College

Fdic Law Regulations Related Acts Rules And Regulations

Fdic Law Regulations Related Acts Rules And Regulations

Buying Your First Home There S A Lot To Know Here Are Some Great Tips To Help You Navigate Home Buying Tips Home Buying Home Ownership

Buying Your First Home There S A Lot To Know Here Are Some Great Tips To Help You Navigate Home Buying Tips Home Buying Home Ownership

Value Of Deposits Of Fdic Insured Commercial Banks 2019 Statista

Value Of Deposits Of Fdic Insured Commercial Banks 2019 Statista

Fdic Graphs Show The Extent Of The Financial Crisis Nyse C Seeking Alpha

Lease Financing Receivables Of Fdic Insured Banks 2019 Statista

Lease Financing Receivables Of Fdic Insured Banks 2019 Statista

Fdic Problem Bank List Definition

The Fdic S New Commandment Wsj

The Fdic S New Commandment Wsj

The Credit Union Difference Credit Union Marketing Ideas Credit Union Credit Union Marketing

The Credit Union Difference Credit Union Marketing Ideas Credit Union Credit Union Marketing

Fdic Strategic Plan Home 2020 Annual Performance Plan

Fdic Strategic Plan Home 2020 Annual Performance Plan

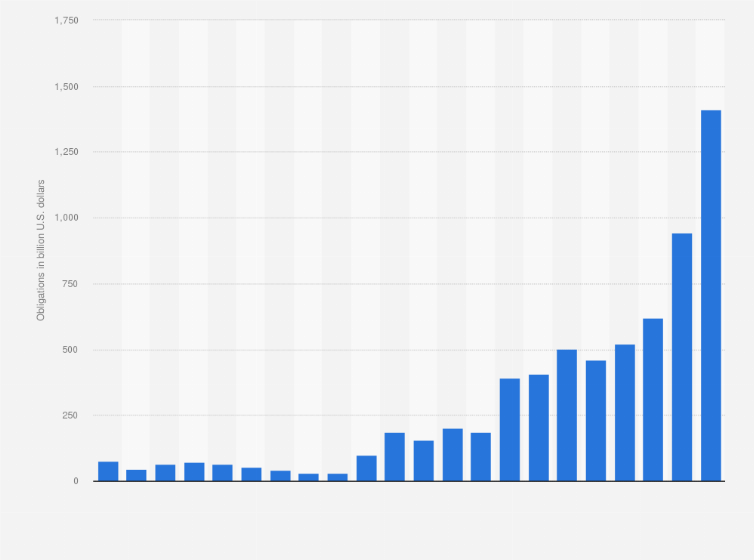

U S Treasury Obligations Of Fdic Insured Banks 2019 Statista

U S Treasury Obligations Of Fdic Insured Banks 2019 Statista

Fdic List Of Problem Banks Shrinks For First Time Since 2006 Aug 23 2011

Fdic List Of Problem Banks Shrinks For First Time Since 2006 Aug 23 2011

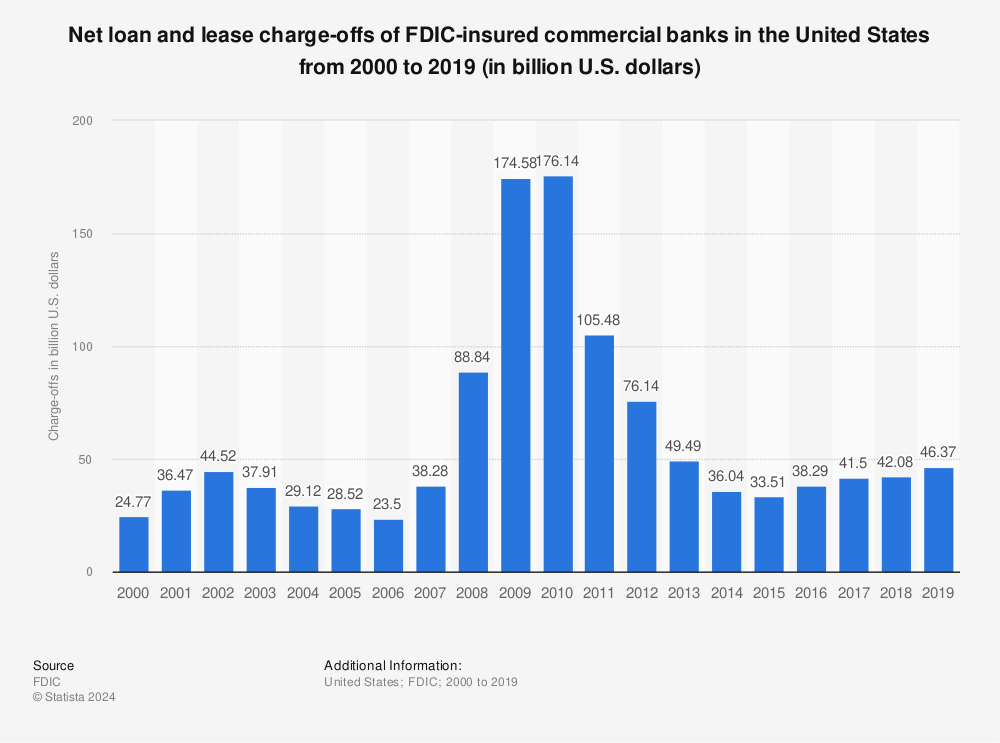

Net Loan And Lease Charge Offs Of Fdic Insured Banks 2019 Statista

Net Loan And Lease Charge Offs Of Fdic Insured Banks 2019 Statista

Division Of Resolutions And Receiverships Claims Manual Vol Fdic

Division Of Resolutions And Receiverships Claims Manual Vol Fdic

Waconia Mn Security Bank Trust Co 2019 Ad Banks Ads Banking Business Person

Waconia Mn Security Bank Trust Co 2019 Ad Banks Ads Banking Business Person